Considering the dynamic business landscape, many entrepreneurs and corporations are opting to move company to Texas to reap numerous advantages. The economic environment, tax benefits, and growth potential make it a compelling choice. Whether you’re looking to move LLC to Texas or transfer corporation to Texas, understanding the steps and benefits is crucial.

Why Texas?

Texas offers a thriving economy, favorable tax conditions, and a supportive regulatory environment. The state has no corporate income tax and provides various tax incentives, making it an attractive destination for businesses.

Steps to Move Your Business to Texas

To successfully move business to Texas, you need to follow specific legal and administrative steps. Here’s a detailed breakdown:

1. Consultation and Planning

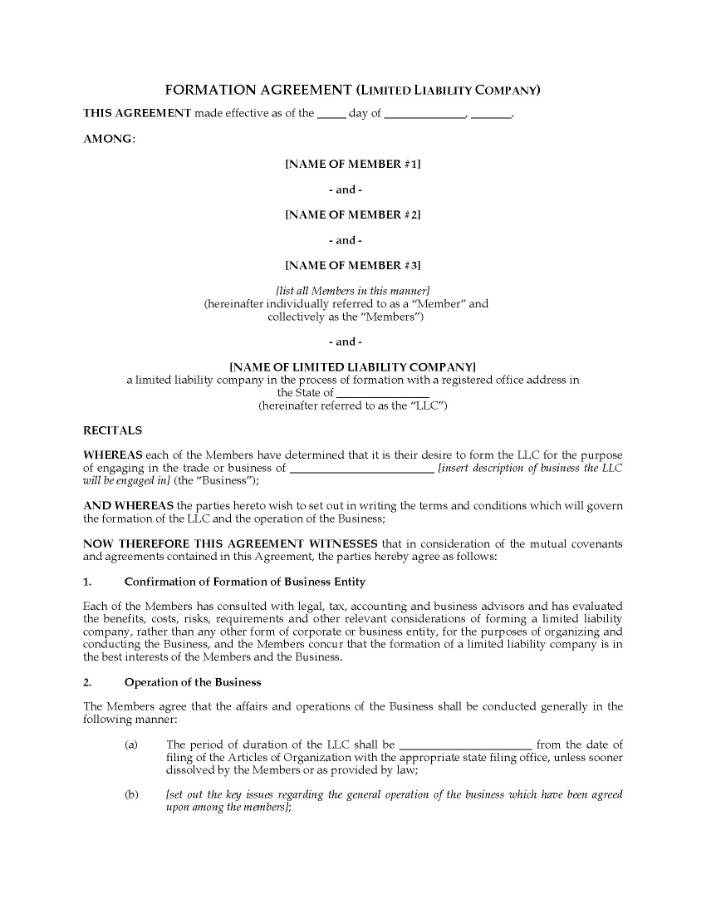

Begin by consulting legal and business advisors to understand the implications and requirements of moving your business. Planning is essential to ensure a smooth transition.

2. Registering Your Business

Depending on your business structure, whether you plan to transfer LLC to Texas, transfer corporation to Texas, or any other form of business, you need to register with the Texas Secretary of State. This involves filing the appropriate forms and paying the necessary fees.

3. Notify Stakeholders

Communicate with all relevant stakeholders, including employees, clients, and partners, about your plans to transfer company to Texas. Transparency ensures continued trust and seamless operations during the transition.

Read more about move llc to texas here.

4. Update Business Documents

Amend your business documents, such as articles of incorporation or organization, to reflect your new Texas address. This step is vital for legal and operational consistency.

5. Obtain Necessary Permits and Licenses

Ensure that your business complies with Texas state regulations by obtaining all required permits and licenses. This might vary depending on the industry and locality.

6. Tax Registration

Register for state taxes with the Texas Comptroller of Public Accounts. This step is mandatory for businesses to operate legally within the state.

Advantages of Transferring Your Business to Texas

Relocating your enterprise to Texas can offer several benefits:

- Tax Efficiency: The absence of corporate income tax can lead to significant savings.

- Business Growth: Texas is known for its vibrant economy and growth opportunities in diverse sectors.

- Regulatory Benefits: A business-friendly regulatory environment makes it easier to comply and operate.

- Quality of Life: Texas provides a high quality of life for both business owners and employees, contributing to job satisfaction and retention.

Whether you are planning to move LLC to Texas or undertake a more complex transfer corporation to Texas, the Lone Star State offers abundant opportunities for growth and success.

Final Thoughts

The decision to transfer business to Texas can be a strategic move that positions your enterprise for long-term success. With proper planning and execution, Texas can provide the fertile ground needed for your business to thrive. Consider all factors, consult with professionals, and embark on this journey to capitalize on the advantages that await in Texas.