Considering a major business relocation? The Sunshine State is emerging as a top destination. Whether you plan to move your company to Florida, transfer your business operations, or even move your LLC to Florida, there are countless benefits to making this strategic shift. This article will guide you through the crucial steps involved in relocating your enterprise to this business-friendly state.

Top Reasons to Transfer Your Company to Florida

Why are so many businesses choosing to move their corporation to Florida? Here are some compelling reasons:

Tax Advantages

Florida boasts a favorable tax environment, including no state income tax for individuals. This can result in significant savings for businesses and their owners, making it financially attractive to transfer your business to Florida.

Business-Friendly Regulations

The state government offers an array of incentives and streamlined regulations to encourage business growth. Companies find it easier to comply with local laws when they transfer their LLC to Florida.

Quality of Life

Florida’s high quality of life is another draw. Excellent weather, beautiful beaches, and a relatively low cost of living make it appealing for entrepreneurs looking to move their corporation to Florida.

Steps to Transfer Your Business to Florida

1. Understand Legal Requirements

Before you can move your LLC to Florida or transfer any business structure, it’s crucial to understand the legal requirements. This includes registering your business with the Florida Division of Corporations and meeting any industry-specific regulations.

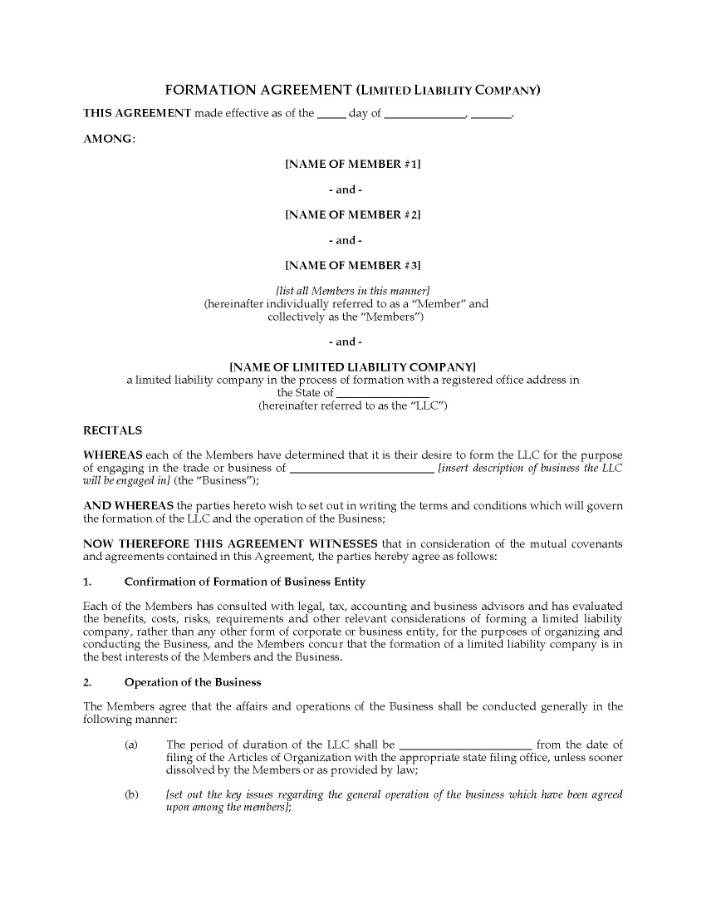

2. Record Your Decision

Owners and board members should formally document the decision to transfer the company to Florida. Meeting minutes and formal agreements will be necessary for legal purposes.

3. File for Correct Permits and Licenses

To successfully move your business to Florida, you must ensure that all necessary permits and licenses are transferred or newly acquired under Florida law.

Read more about transfer corporation to florida here.

4. Update Business Address and Documents

Ensure your business address is updated across all relevant documents, including bank accounts, marketing materials, and customer communications. Notifying stakeholders of your decision to move your company to Florida is also essential.

5. Consider Tax Implications

While Florida offers numerous tax benefits, you should consult with a tax advisor to understand the specific implications of your move and to optimize your financial situation.

Choosing the Right Support for Your Business Move

Hiring Professional Services

Services like business consultants, legal advisors, and moving companies can make the process of relocating your business smoother. Specialized professionals can guide you through the intricacies involved when you move your corporation to Florida.

Networking and Local Resources

Upon deciding to transfer your business to Florida, tapping into local business networks can provide additional support and resources. Chambers of Commerce, business groups, and local advisors can offer valuable insights and aid in the transition.

Relocating your business is a significant decision but making the move can open up exciting new opportunities. With the right planning and resources, your transition can be seamless, allowing you to fully capitalize on everything the state has to offer.