Businesses across the nation are increasingly considering opportunities to move company to Texas due to the state’s business-friendly environment, low taxes, and diverse economy. Whether you’re planning to move LLC to Texas, move corporation to Texas, or transition any other business structure, Texas offers a compelling landscape for growth and expansion.

Why Transfer Your Business to Texas?

The Lone Star State has become a top destination for businesses looking to relocate. Key benefits include:

- No State Income Tax: Texas is one of the few states that doesn’t levy a personal income tax, which can be a substantial financial benefit for business owners and employees alike.

- Pro-Business Environment: Texas frequently ranks highly in national surveys for being a friendly state for businesses, featuring fewer regulations and limited bureaucratic red tape.

- Diverse Economy: From energy and technology to agriculture and healthcare, Texas boasts a diversified economy that can support a wide range of industries.

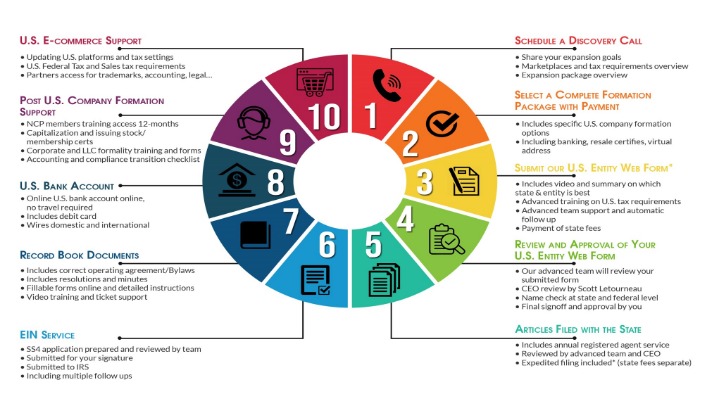

Steps to Transfer an LLC to Texas

If you’re planning to transfer LLC to Texas, the process can be straightforward with proper planning:

- Check Existing State Requirements: Each state has specific rules regarding LLC relocation. Ensure compliance with your home state’s regulations for dissolving or transferring the business.

- Register in Texas: File a Certificate of Authority with the Texas Secretary of State’s office to legally conduct business.

- Update Operating Agreement: Adjust the operating agreement to reflect the new jurisdiction and address any legal requirements unique to Texas.

- Update Taxes and Licenses: Ensure all federal and Texas-specific tax registrations are updated, and apply for any necessary local business licenses.

Transferring a Corporation to Texas

The steps to transfer corporation to Texas are similar to moving an LLC but come with additional considerations:

- Board Approval: Obtain approval from the board of directors and shareholders, as required by your home state’s corporate laws.

- File for Foreign Qualification: Register as a foreign entity in Texas, allowing the corporation to operate legally within the state.

- Dissolve Existing Corporation: Depending on your legal strategy, you may choose to dissolve the corporation in the original state or maintain dual registrations.

- Federal and State Compliance: Update the Internal Revenue Service (IRS) and Texas Comptroller of Public Accounts with the new business address and any other relevant changes.

Key Considerations for Business Relocation

Read more about transfer corporation to texas here.

When you move business to Texas, several important factors should be taken into account to ensure a seamless transition:

- Logistics and Operations: Plan the physical move carefully, including relocation of staff and equipment.

- Legal and Regulatory Issues: Compliance with both federal and state laws is critical. Seek legal advice to navigate the complex landscape.

- Employee Transition: Consider the impact on your workforce and provide the necessary assistance to ensure an easy move for them as well.

For those planning to transfer business to Texas, proper preparation and understanding of the process can lead to a smoother transition and set the stage for continued growth and success in one of the nation’s most vibrant states.